Theta Equity Partners in 2018: The CBCV Revolution Has Begun

We started Theta Equity Partners this past May with one goal: to revolutionize finance through customer-based corporate valuation (CBCV). Our mission is to help anyone involved with financial valuation in some capacity – private equity and venture capital firms, hedge funds, valuation advisory firms, companies themselves, and many more – to gain deeper insight into the customer-level unit economics of businesses and their implications for the overall financial valuation of companies. We provide these stakeholders with highly accurate, state-of-the-art customer lifetime value (CLV) predictions which, in conjunction with customer acquisition cost (CAC) data, gives them a better estimate of the fair valuation of firms, as well as a better understanding of the customer-based risks and opportunities these stakeholders should be aware of when considering an investment.

As this year is coming to an end, we’d like to share what we have achieved in the eight months that have passed since our inception. We’re proud to say that it is a lot.

1) Applying CBCV at scale

Even though we had known from our academic work that CBCV is a powerful tool to value companies by predicting what their customers are likely to do in the future, our many engagements through Theta have shown that CBCV is far more than just an academic exercise; we have shown that it can be successfully applied at full commercial scale across a wide range of companies. Since May, we have helped a number of private equity and venture capital firms make decisions on whether to invest in companies and at what valuation. We have also helped the executives at a number of companies understand what their valuations are. We’ve built more than 25 CBCV models and analyzed more than 40M transactions made by more than 16M customers, not counting the “outside-in” analyses that we have performed on publicly traded companies (sometimes, but not always, commissioned by them), covering more than 200M customers. It has been illuminating working with stakeholders on both sides of the valuation exercise – those doing the investing and those being invested in – and believe this unique perspective will allow us to be even more useful to both parties going forward.

2) Making CBCV interactive

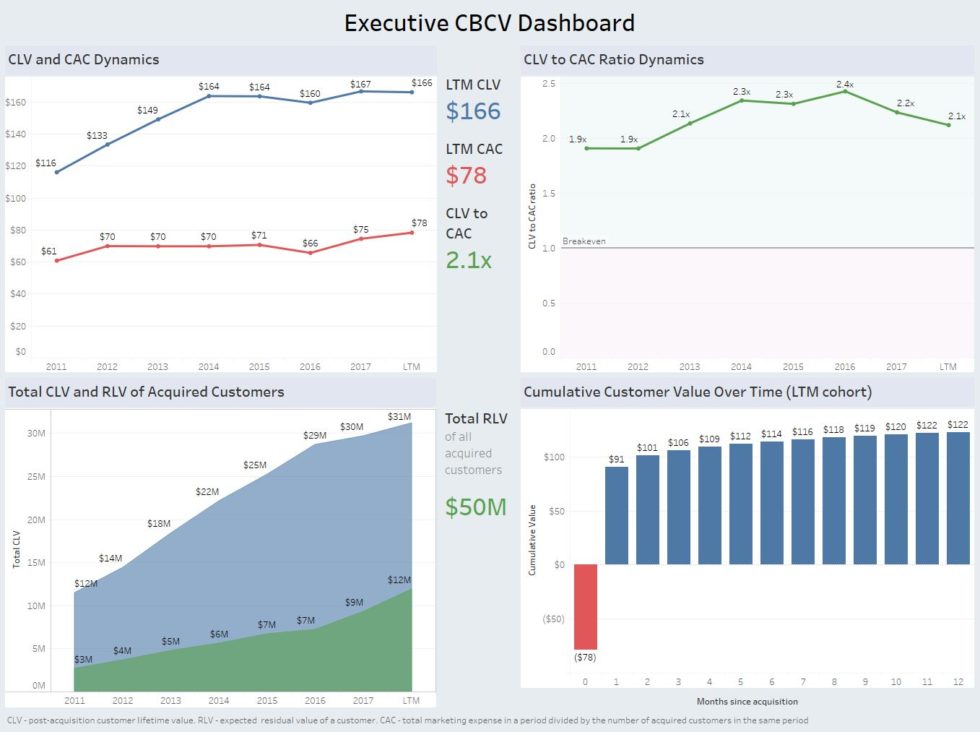

Working on deals with our clients has given us a much clearer understanding of the intermediate metrics that lie somewhere between unit economics and overall firm valuation. We’ve evolved from just delivering the key numbers (CLV and its dynamics), to an interactive tool – a CBCV dashboard – that allows firms to dig deeper into customer value and understand how to manage it through customer acquisition, retention, and development. Essentially, this tool brings to life the link between CBCV and customer centricity – two interrelated concepts that companies should use in tandem to maximize their valuation.

3) Building a bridge between finance and marketing

CBCV provides a common language that enables the CFO and CMO to communicate more effectively with one another. This has always been an aspiration in our academic work, but we’ve seen it come to life at Theta – and the results have been remarkable. Gone are the days when marketing initiatives relied primarily on fuzzy and intangible impact metrics (customer engagement, brand value, etc.), thus making it nearly impossible to rigorously measure marketing ROI, properly allocate resources, and earn the respect of finance executives. Every marketing decision affects customer acquisition, retention, and/or spend – and CBCV enables companies to link them to the overall company value. In our work, we are always excited to see how marketing and finance executives have been collaborating around CBCV and making operational decisions that directly arise from the results. This is a great step towards building a viable and long-lasting partnership between the two functions, leading to financially viable customer-centric growth.

In sum, we begin 2019 more confident than ever that Theta Equity Partners will continue to excel at – and expand upon – its mission: the customer-based corporate valuation revolution has begun and there’s no stopping it. We are grateful to be on the forefront of this seismic change, and we are truly grateful to you – our readers, friends, family, and clients – for being such an important part of our journey.

Warmly,

Team Theta

Peter Fader

Dan McCarthy

Val Rastorguev

Nickhil Nabar