Maximize Return on Your Investments

Leverage deeper customer value insights at every stage of the investment process

Insights

When it comes to investment decisions, knowledge and speed give your firm the competitive edge

Theta offers fast customer-based insights that no one can match. We accurately predict customer retention, repeat purchasing, spend, and overall value, giving you immediate advantages at every stage of the investment process.

Better understand your target’s economics, more accurately estimate its current and future value, and identify ways to enhance it. A more comprehensive due diligence process means more confidence to make the right move.

Identify levers that improve revenue streams for your current portfolio companies and detect sources of company value ignored by traditional valuation methods to maximize ROI when exiting a company.

Theta makes it possible.

Sharpen Your due diligence

Create More Customer Value

Maximize ROI on Your Exit

Theta gives you the advantage at every stage of the investment process

Due diligence

Gain a competitive edge in bidding with comprehensive customer value insights

Theta provides deeper insight into a target company’s customer quality, stability of existing revenue streams, and levers to improve the value of new revenue streams, so you can:

- Find hidden gems and undervalued companies

- Avoid “lemons” and overpriced companies

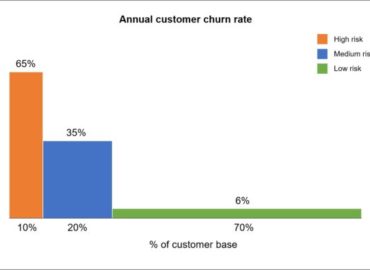

- Identify customer red flags early

- Determine new customer value opportunities

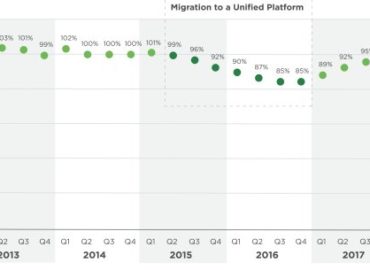

- Better forecast customer acquisition, retention, revenue and profits

Portfolio company operation

Improve customer value of portfolio companies through deeper insight and more targeted tactical actions

Theta provides you a holistic portfolio-level view of your investments’ customer value and strategic and tactical insights on how to improve it:

- Standardize reporting to get a better view on customer value by estimating Customer Lifetime Value (CLV) trend and CLV to CAC ratio dynamics, and more

- Reallocate marketing budgets towards more effective customer acquisition channels

- Design and implement more targeted customer retention and development tactics

- Accurately forecast and compare each company’s future size of customer base, revenues, profits, etc., based on detailed predictions of customer behavior

Exit

Maximize return on investment when exiting a portfolio company

By applying our Customer-Based Corporate Valuation® methodology (CBCV) to predict what company’s customers will do in the future, Theta helps you find sources of company value usually ignored by traditional valuation methods:

- Have an accurate data-based view on the portfolio company valuation

- Showcase full value of the portfolio company to potential buyers

- Maximize return on investment when exiting a portfolio company

Case Studies

Check out our latest case studies and use cases.

Some of our valued clients

What our clients say…

Testimonials

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.”

– JON THORNTON

Testimonials

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.”

– JON THORNTON

Testimonials

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.”

– JON THORNTON

Check out our blog articles, CBCVs and other resources.

Ready to speak with the Theta team?

Contact us today