Lyft IPO: Despite Positive CLV, Hard to Justify Its $20-25B Target Valuation

In our previous post on Lyft, we assessed the firm’s unit economics by analyzing its pre-IPO filing. We concluded that while losses are currently very large, it is possible for Lyft to grow itself into profitability because it acquires customers profitably, with strong long-term repeat buying from a relatively small segment of highly loyal customers.

In this post, we move from unit economics to overall financial valuation so that we can give our Customer-Based Corporate Valuation (CBCV) view on whether their target IPO valuation of $20-25B is justified by the stream of future cash flows we can expect from the firm. In doing so, we take the model that we fit earlier and use it to project what future customer acquisitions will be, the stream of revenue we can expect from those customers after they have been acquired, how that revenue will flow through into variable profits, and how much of that variable profitability the firm will be able to keep after deducting fixed costs.

Cutting to the chase, our results suggest that Lyft’s target valuation is not justified by their fundamentals under any practically realistic future state of the world. Our more optimistic scenario implies a fair valuation of about $7B, while our base case scenario implies a fair valuation of $4.5B.

While we will discuss every one of the contributing factors that lead us to these conclusions, some of the main reasons for this cautionary view of their valuation are the following:

- Lyft’s fixed costs are too high. CLV is a variable profitability measure, so the fact that Lyft has a positive average CLV implies nothing about Lyft’s fixed cost structure (if anything, average CLV at a company may be positively correlated with the amount of fixed costs a business has, because companies that invest heavily in automation improve the variable cost profile at the expense of having more fixed costs). Well, Lyft’s fixed costs are very large. We estimate that they will spend $900M over the next year on R&D and G&A alone, so a $19 CLV per customer means they will need to acquire almost 50M customers just to pay for these fixed costs in NPV terms, let alone justify a $20-25B valuation for the equity. Holding aside fixed costs, $20B of equity value can be thought of as 1.1B customers acquired right now at an average CLV of $19 – that’s a lot of customers! By way of comparison, we estimate that Lyft has acquired 57M customers to date, and there are “only” 189M credit card holders in the entire United States. Even using simple numbers, it is hard to see how the math works.

- Expanding overseas is no silver bullet. If Lyft were to restrict itself primarily on the US market, it would be much easier for the company to spend the next few years focusing on cost efficiency. The opposite would almost certainly be true if they were to make a big push into overseas markets. Even when we make relatively optimistic assumptions about Lyft’s ability to penetrate the rest of the world, and all the incremental customer acquisitions that come with it, the net effect on Lyft’s fair valuation goes up but still does not put us anywhere close to the current $20-25B target IPO valuation.

Given this relatively bearish conclusion, it is ironic that after we posted our analysis of Lyft’s unit economics, many people bearish on Lyft had emailed us, aghast that we inferred a positive CLV for an average newly acquired customer. Stopping to think for a moment, $19 in CLV per customer is not bullish for Lyft’s stock at a $20-25B valuation, no matter how you cut the numbers.

Next, we lay out the valuation model and what is driving it before diving into the various valuation scenarios summarized above.Valuation model and assumption

To convert the customer value insights that we discussed in the last post into overall fair valuation estimates, we first combined the customer behavior models (acquisition, churn, repeat riding, and spend) to generate future revenue forecasts. Then we use a traditional discounted cash flow valuation model to estimate the fair valuation of the company’s equity. We primarily consider two scenarios:

- Baseline NA: we assume that Lyft continues its growth within the US and Canada with a target margin profile more common among mature companies.

- Baseline NA + international expansion: one could argue that Lyft could follow Uber’s footsteps and move into new markets. We agree that this is possible or even likely, motivating an alternative valuation estimate that bakes in the larger TAM. In this scenario, we assume that Lyft immediately begins an aggressive international expansion, considerably enlarging its potential target market at the expense of a larger number of years until it hits target margins.

Below is a summary of the assumptions we make for each of these scenarios (current margin levels are provided for reference in the leftmost column):

| Assumptions | Current Levels (TTM) | Baseline NA | Baseline NA + International expansion |

|---|---|---|---|

| Potential market | US and Canada (57M adds to date) | US and Canada (400M prospects) | US, Canada, and international expansion (1B prospects) |

| Gross margin | 42.3% | Reaches 50% over the next 3 years | Reaches 50% over the next 5 years |

| Sales & Marketing | $32 CAC (37.3% of sales) | CAC remains stable, but S&M expense goes no lower than 10% of revenue | Same as baseline |

| Operations and Support | 15.7% of sales | Reaches 10% of revenue over the next 3 years | Reaches 10% of revenue over the next 5 years |

| R&D | 120% y/y growth; 13.9% of sales | 15% y/y growth over next 3 years, then 10% of revenue thereafter | 15% y/y growth over next 5 years, then 10% of revenue thereafter |

| G&A | 102% y/y growth; 20.8% of sales | Reaches 10% of revenue over the next 3 years | Reaches 10% of revenue over the next 5 years |

| Capex | 3.2% of sales | Reaches ~3% of revenue over the next 3 years, equal to its D&A at that time | Reaches ~3% of revenue over the next 5 years, equal to its D&A at that time |

A few comments on these assumptions are worth mentioning for context:

- It is hard to find R&D expense of less than 10% of sales at any of the major publicly traded tech firms, even the mature ones.

- The same is true for Sales and Marketing – mature companies spend more (often much more) than this – eBay spends 32% of its revenues on S&M, and even Microsoft is currently spending 16%.

- The difference in the number of years it takes to reach these target margin levels between these scenarios is a byproduct of the aforementioned expected margin weakness if the company were to set its sights more aggressively on overseas markets.

- We assume 400M prospects in the US and Canada to allow for the inevitability of people having multiple accounts over their lifetimes for various reasons.

Valuation: Baseline NA scenario

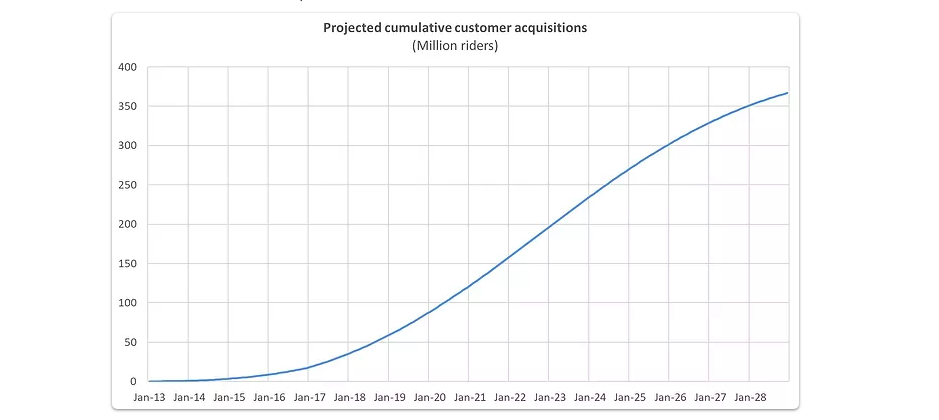

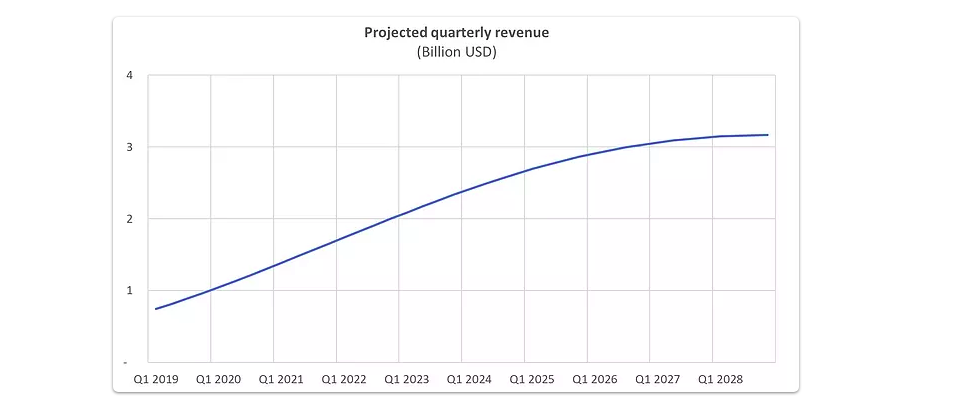

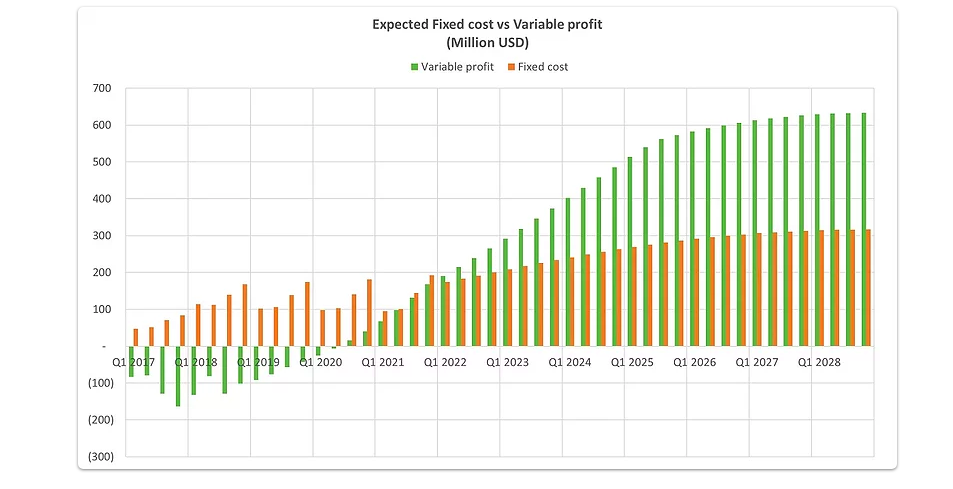

In this scenario, Lyft’s estimated fair equity valuation is ~$4.5 billion, about 80% less than the lower end of Lyft’s target valuation range. The model suggests that Lyft will continue acquiring new riders until the market is fully penetrated. This is a fairly dovish model projection for customer acquisitions. Revenues are projected to continue growing, but growth begins slowing down in 2023-2024, when the target market gets closer to its saturation point. Even though company’s variable profits eventually overtake fixed costs, this happens quite late, and the amount of profits generated thereafter is not nearly enough in net present value terms to justify the target valuation.

The charts below illustrate Lyft’s projected cumulative customer acquisitions and resulting revenue forecasts under the model that we had laid out in our last post:

To get a sense for just how much larger Lyft’s fixed costs are relative to the variable profits being generated through Lyft’s customers, we plot fixed costs against variable profits below. We classify cost of goods sold, operations and support, and Sales and Marketing expenses as variable costs, and G&A and R&D expenses as fixed costs (note: Sales and Marketing does not fit cleanly into a fixed cost / variable cost framework as it is largely driven by the number of customers acquired, but (1) it seems fair to say it is more variable than fixed and (2) either way, it is accounted for in the results below).

While variable profits are projected to grow and eventually exceed fixed costs, the magnitude of the losses before hitting break-even and the relative lack of profits thereafter are why we reach the valuation conclusions we do.Valuation: Baseline NA + International expansion scenario

As noted in the assumptions summary table above, under this scenario we increase the size of the target market to 1B from 400M to account for the larger TAM, and lengthen the time it takes to reach target margins to five years from three to account for the near-term margin weakness we would likely see.

Making these changes, we estimate Lyft’s fair value at $7B, which is still 66% below the bottom end of Lyft’s valuation range. The model-based projection for new customer acquisitions gives Lyft the benefit of the doubt, assuming that they will acquire new riders until the market is fully penetrated, but that this penetration will take longer to achieve. Projected revenues will continue to grow, but due to the international expansion, revenue growth will only start showing sign of slowing down in 2028. Variable profits are expected to overtake fixed costs in 2023, but since revenues are generally higher in this scenario, Lyft will generate more variable profits over time and therefore enjoy a higher valuation.

Conclusion

No matter how we cut the numbers, we have great difficulty arriving at the valuation that Lyft is looking to IPO at. This valuation would be achievable if they were to expand their gross margin to 70% from 45% in Q4 2018 and pull off a successful overseas expansion. While this is possible, requiring this to be true to not lose money investing into the IPO seems like an unfavorable risk/reward position to us.

March 15, 2019

Peter Fader is the author of “The Customer Centricity Playbook” and a co-founder of Theta Equity Partners. Daniel McCarthy is a co-founder and Val Rastorguev is a Director of Theta Equity Partners, a company specialized in Customer-Based Corporate Valuation services — valuing firms by forecasting what their current and future customers will likely do.

This article is for informational and educational purposes only, you should not construe any such information or other material as investment, financial, or other advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, or offer by Theta Equity Partners to buy or sell any securities or other financial instruments.