Value Your Customers to Grow Your Business

With best-in-class predictive customer behavior models

Predictive Models

Best-in-class predictive models provide strategic and tactical insights to improve customer value through better customer acquisition, retention, and development

Customers are the heart and soul of business, but most companies struggle to interpret and act on their most valuable customer data, often making reactive decisions that limit their potential.

Theta developed best-in-class models to accurately predict customer retention, repeat purchasing, and spend so you can better understand the current and future health of your customer base, identify opportunities to improve customer value and translate customer value into the overall company valuation (CBCV).

Whether you’re seeking a competitive advantage, raising capital, or want to improve M&A terms, Theta’s insights will be instrumental in achieving these goals.

Know the future value of your customer base

Improve customer value through strategic and tactical measures

turn customer unit economics into overall company valuation

Strategic Insights

Know the future value of your customer base to chart the roadmap for your business

Theta’s predictive models of customer behavior offer the most accurate view of customer value and enable you to make better and bolder business decisions

- Analyze predictive CLV, CLV to CAC, payback period, and other metrics of customer value

- Identify trends in key customer metrics to know where your business is heading

- Slice and dice customer value insights by segment to reallocate marketing budget, optimize product line, target geographies, etc.

Tactical Actions

Take practical steps to improve your customer value

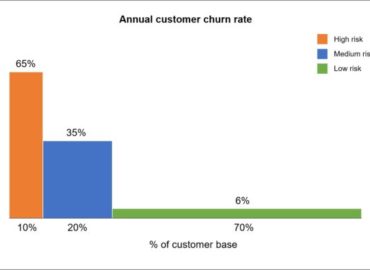

Theta’s CLV-based segmentation of your customer base will enable you to design and implement highly targeted tactical initiatives to acquire, retain, and develop the right customers

- Identify your best customers, know what makes them distinct, and acquire more customers like them

- Find valuable customers at risk of churning and retain them through targeted campaigns

- Identify customers with the greatest growth potential and develop them

Customer-Based Corporate Valuation® (CBCV)

Convert customer unit economics into overall company valuation

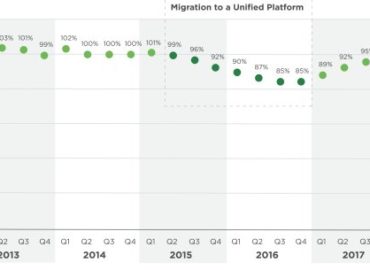

Developed by Theta’s co-founders, Customer-Based Corporate Valuation methodology (CBCV) provides a more accurate view of the value of your entire company. See where your company stands today and how different customer and financial assumptions impact your CBCV valuation in real-time.

- Uncover hidden sources of your company value by more accurately predicting what your customers will do in the future

- Evaluate different valuation scenarios as a result of customer initiatives in real time (e.g., if we were to decrease churn by 3%, what will it do to our equity value?)

- Ensure better goal alignment between marketing and finance

Some of our valued clients

Testimonials

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.”

– JON THORNTON

Testimonials

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.”

– JON THORNTON

Testimonials

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.”

– JON THORNTON

Check out our blog articles, CBCVs and other resources.

Ready to speak with the Theta team?

Contact us today